Alphabet Inc.’s (NASDAQ:GOOG) (NASDAQ:GOOGL) latest advancements in artificial intelligence and quantum computing are helping the tech giant rebuild its reputation and investor confidence.

What Happened: After the release of OpenAI’s ChatGPT in late 2022, Google had reportedly declared a “Code Red,”

The company faced criticism for lagging behind rivals like Microsoft Corporation (NASDAQ:MSFT), which partnered with OpenAI to integrate ChatGPT-like capabilities into its products.

However, Google’s latest developments have shifted the narrative, reported Financial Times.

See Also: OpenAI’s ChatGPT Makes Headway In Search, Threatening Google’s Reign

“Alphabet has been under the microscope since ChatGPT was released,” said Tiffany Hsia, a U.S. equity portfolio manager at AllianceBernstein and a Google shareholder. “Gemini 2.0 and the quantum chip give investors renewed confidence that they are one of the leading tech powerhouses.”

This year, Google launched Gemini 2.0, Veo 2 and Imagen 3 models for video and image generation, along with a quantum computing breakthrough with its Willow chip.

It also unveiled a custom AI accelerator chip, the Trillium Tensor Processing Unit, to challenge Nvidia Corporation’s (NASDAQ:NVDA) dominance.

Other innovations include Project Mariner, which compiles research reports and acts on behalf of users, and Project Astra, which enables real-time answers across text, video, and audio through smart glasses.

Why It Matters: Google has also faced growing competition and scrutiny. It still dominates the search market with a 90% share, but new players like OpenAI and Anthropic pose a credible threat.

The company also faces regulatory hurdles with the U.S. Department of Justice seeking to break up Google’s ad tech business and is challenging its dominance in search.

Last week, Google also cut 10% of its top management positions as part of a multi-year initiative to streamline operations and enhance efficiency.

Despite these challenges, Alphabet Class A and C shares have risen around 38% on a year-to-date basis.

It currently has a market capitalization of $2.351 trillion, making it the fifth most valuable company in the world following Apple, Nvidia, Microsoft and Amazon.

Price Action: Alphabet’s Class A shares rose by 1.54% on Friday, closing at $191.41, while Class C shares climbed 1.72% to end at $192.96, according to Benzinga Pro data.

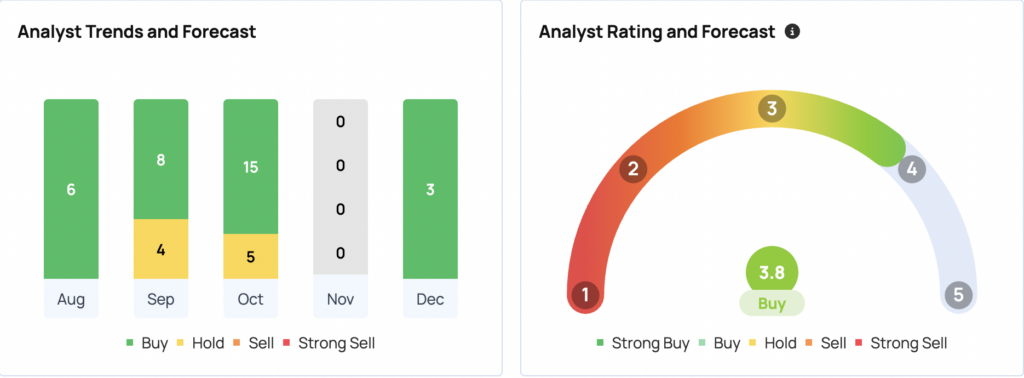

The latest analyst updates from JP Morgan, Goldman Sachs, and Baird place an average price target of $215.67 on Alphabet’s Class A shares, suggesting a potential gain of 11.87%.

Similarly, Oppenheimer, Jefferies, and Pivotal Research have set an average price target of $225 for Class C shares, projecting an upside of 15.9%.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.