Phillips 66 (NYSE:PSX) will release its fourth-quarter financial results, before the opening bell, on Friday, Jan. 31, 2025.

Analysts expect the Houston, Texas-based company to report a quarterly loss at 23 cents per share, versus year-ago earnings of $3.09 per share. Phillips 66 projects quarterly revenue of $32.24 billion, compared to $38.74 billion a year earlier, according to data from Benzinga Pro.

On Jan. 6, the company disclosed a definitive deal to acquire EPIC Y-Grade, LP’s natural gas liquids (NGL) business for $2.2 billion in cash.

Phillips 66 shares fell 1.1% to close at $120.84 on Thursday. .

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

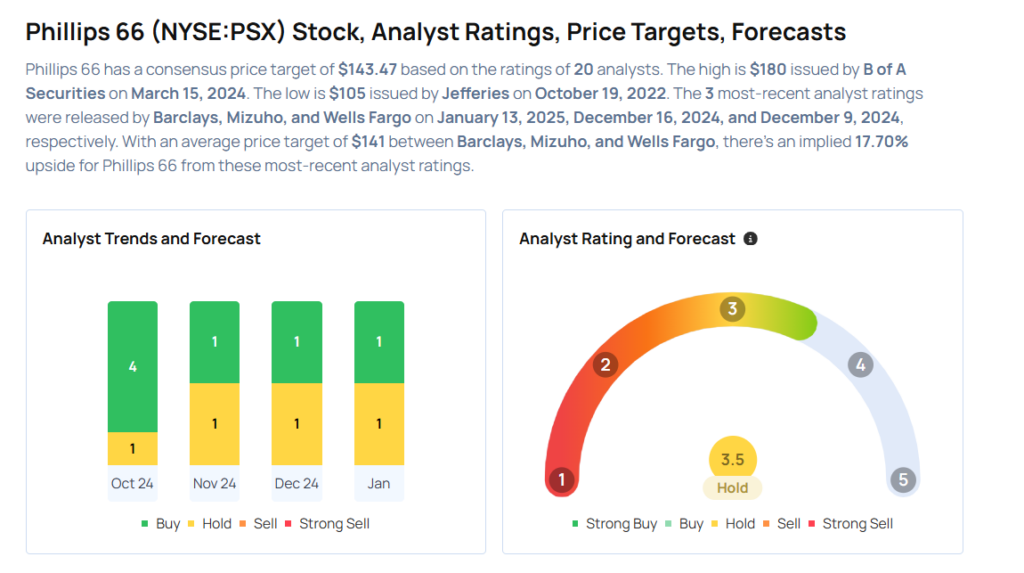

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and cut the price target from $124 to $115 on Jan. 13, 2025. This analyst has an accuracy rate of 77%.

- Wolfe Research analyst Doug Leggate upgraded the stock from Peer Perform to Outperform on Jan. 3, 2025. This analyst has an accuracy rate of 70%.

- Wells Fargo analyst Roger Read maintained an Overweight rating and cut the price target from $167 to $161 on Dec. 9, 2024. This analyst has an accuracy rate of 65%.

- UBS analyst Spiro Dounis maintained a Buy rating and cut the price target from $150 to $138 on Nov. 4, 2024. This analyst has an accuracy rate of 74%.

- Piper Sandler analyst Ryan Todd maintained an Overweight rating and raised the price target from $136 to $144 on Oct. 8, 2024. This analyst has an accuracy rate of 68%.

Considering buying PSX stock? Here’s what analysts think:

Read This Next: