Carnival Corporation (NYSE:CCL) will release its fourth-quarter financial results, before the opening bell, on Friday, Dec. 20.

Analysts expect the Miami, Florida-based company to report quarterly earnings at 7 cents per share, versus a year-ago loss of 7 cents per share. Carnival projects quarterly revenue of $5.93 billion, compared to $5.4 billion a year earlier, according to data from Benzinga Pro.

On Sept. 30, Carnival posted third-quarter adjusted earnings of $1.27 per share, beating analysts’ estimates of $1.16 per share. The company posted quarterly sales of $7.90 billion versus expectations of $7.83 billion.

Carnival shares gained 1.5% to close at $25.18 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

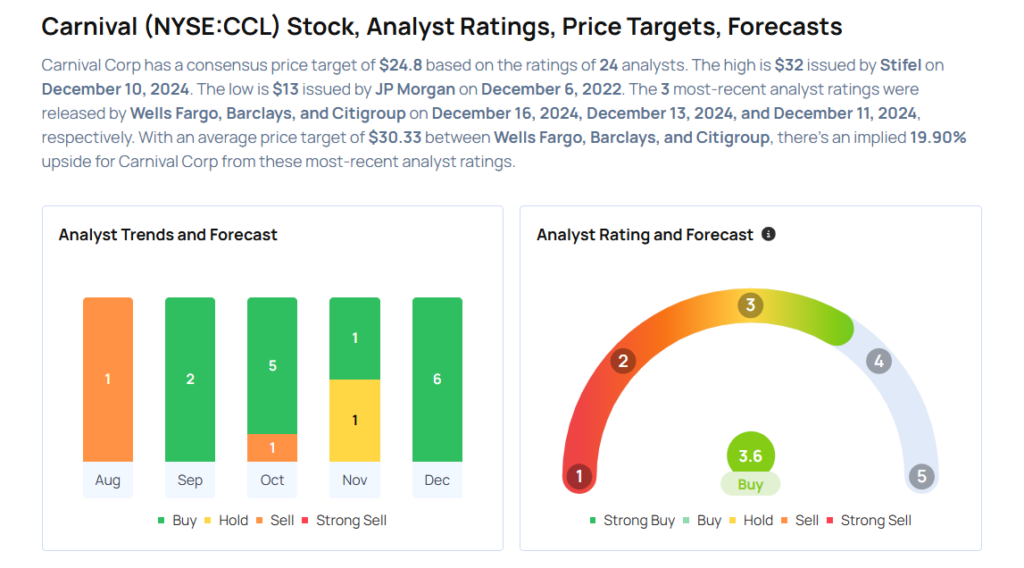

- Wells Fargo analyst Daniel Politzer maintained an Overweight rating and raised the price target from $25 to $30 on Dec. 16. This analyst has an accuracy rate of 64%.

- Barclays analyst Brandt Montour maintained an Overweight rating and increased the price target from $26 to $31 on Dec. 13. This analyst has an accuracy rate of 68%.

- Citigroup analyst James Hardiman maintained a Buy rating and increased the price target from $28 to $30 on Dec. 11. This analyst has an accuracy rate of 68%.

- Stifel analyst Steven Wieczynski maintained a Buy rating and raised the price target from $27 to $32 on Dec. 10. This analyst has an accuracy rate of 71%.

- Goldman Sachs analyst Lizzie Dove maintained a Buy rating and increased the price target from $24 to $32 on Dec. 10. This analyst has an accuracy rate of 67%.

Considering buying CCL stock? Here’s what analysts think:

Read This Next: