Citigroup Inc.‘s (NYSE:C) new Strata Elite credit card will be launched on Monday, which will be competing against JPMorgan Chase & Co.‘s (NYSE:JPM) Chase Sapphire Reserve and American Express Co.‘s (NYSE:AXP) Platinum cards.

Check out Citi’s latest stock price here.

Citi’s Strata Elite

- Citi’s new Strata Elite enters the premium card market with a $595 annual fee, aiming for straightforward travel rewards.

- It offers high multipliers on dining/food delivery weekends, a $300 hotel credit, and a $200 “splurge” credit, plus American Airlines Admirals Club passes.

- Its appeal is simplicity for frequent travelers, contrasting with rivals’ increasingly complex perks.

JPMorgan’s Chase Sapphire Reserve

- JPMorgan Chase’s Sapphire Reserve, now at a $795 annual fee, emphasizes high-value travel and dining rewards.

- It offers 3x points on travel/dining, higher multiples via the Chase Travel portal, robust travel protections, and Priority Pass Select.

- It balances strong earnings with flexible redemptions, appealing to serious travelers and foodies.

Amex Platinum Card

- The American Express Platinum, with a $695 annual fee, focuses on a broader lifestyle approach.

- It provides extensive lounge access (including Centurion Lounges) and a wide array of statement credits for various services, though these require active management to maximize.

- Its strength lies in diverse luxury benefits and 5x points on flights.

Why It Matters: This comes as credit-card issuers increasingly focus on high-net-worth individuals, who are more likely to pay steep annual fees and maintain healthy balances, offering significant revenue potential beyond just interest.

Citi’s push into this segment aligns with its broader strategy to expand its credit card footprint and deepen relationships with wealthier clientele.

The head of U.S. personal banking at Citi, Gonzalo Luchetti, told the Wall Street Journal that “pricing definitely has moved up over time, and people are willing to take on greater fees.”

Price Action: The shares of Citigroup ended 0.71% higher at $96.07 apiece on Friday, and it rose 37.36% on a year-to-date basis. The stock has gained 49.41% over the last year.

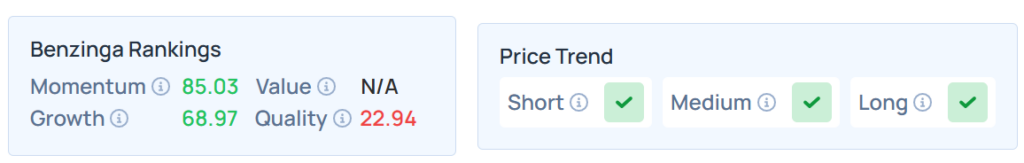

Benzinga’s Edge Stock Rankings indicate that Citi maintains solid momentum across short, medium, and long-term periods. However, while the stock scores well on growth rankings, its quality rating remains relatively weak. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Friday. The SPY was up 0.42% at $637.10, while the QQQ advanced 0.24% to $566.37, according to Benzinga Pro data.

On Monday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock