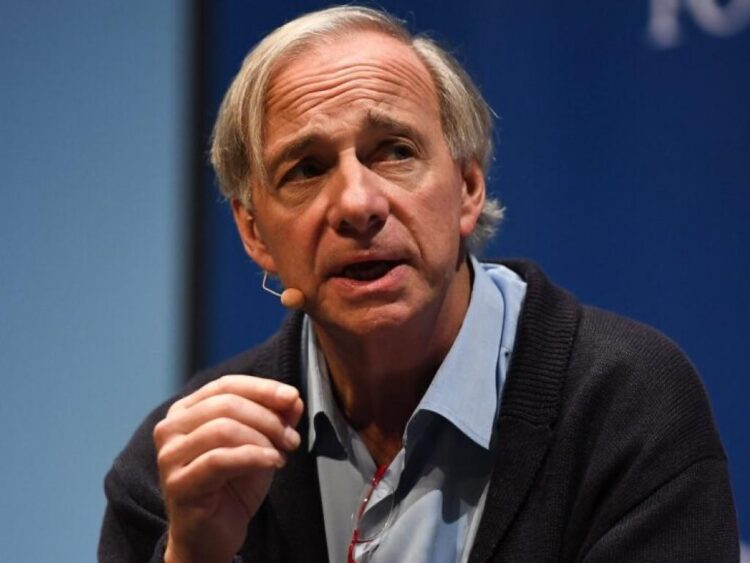

Following the recent comments from billionaire investor Ray Dalio on “expensive,” companies with high valuations, his fund Bridgewater Associates trimmed its positions in six of the ‘Magnificent 7’ stocks during the fourth quarter, while taking a fresh position in Elon Musk-led Tesla Inc. (NASDAQ:TSLA).

What Happened: According to its 13-F filing with the U.S. Securities And Exchange Commission, the ‘Magnificent 7’ stocks witnessed a double-digit cut in their positions at Bridgewater, except Tesla.

- Decreasing about 40% of its existing holdings, Apple Inc.‘s (NASDAQ:AAPL) value in Bridgewater’s portfolio stood at the lowest among the ‘Magnificent 7’ stocks at $154.559 million, as of Dec. 31, 2024.

- Bridgewater held the most Class A Alphabet Inc. (NASDAQ:GOOGL) shares in the said quarter among the ‘Magnificent 7,’ trimming just 17% of its position from the third quarter, valued at $685.513 million.

- Positions in Nvidia Corp. (NASDAQ:NVDA), Meta Platforms Inc. (NASDAQ:META), Microsoft Corp. (NASDAQ:MSFT), and Amazon.com Inc. (NASDAQ:AMZN) were also slashed in double digits from the third to the fourth quarter.

- However, Dalio’s fund added 153,589 shares of Tesla to its portfolio for the first time in three years after the fourth quarter of 2021. It was valued at $62.025 million.

| Company | Holdings (as of Sept. 30) | Holdings (as of Dec. 31) | Change (in %) | Value As Of Dec. 31 |

| Alphabet Inc. (NASDAQ:GOOGL) | 4,379,337 | 3,621,308 | -17% | $685.513 million |

| Nvidia Corp. (NASDAQ:NVDA) | 4,754,271 | 3,497,362 | -26% | $469.660 million |

| Meta Platforms Inc. (NASDAQ:META) | 802,202 | 621,088 | -23% | $363.653 million |

| Microsoft Corp. (NASDAQ:MSFT) | 870,178 | 667,036 | -23% | $281.155 million |

| Amazon.com Inc. (NASDAQ:AMZN) | 1,411,643 | 919,786 | -35% | $211.684 million |

| Apple Inc. (NASDAQ:AAPL) | 1,031,856 | 617,203 | -40% | $154.559 million |

| Tesla Inc. (NASDAQ:TSLA) | 0 | 153,589 | 0% | $62.025 million |

See Also: Billionaire Ray Dalio Raises Valuation Concerns As DeepSeek’s New Model Hits Nvidia Stock

Why It Matters: Dalio, in a discussion with David Friedberg on the All-In Podcast, cautioned against solely focusing on “good” companies, following the tech stock rout after the popularity of Chinese AI firm DeepSeek.

“A great company that gets expensive is much worse than a bad company that’s really cheap,” he warned. Dalio urged investors to prioritize value and consider pricing dynamics, especially in the current economic climate.

He expressed concerns about the “superscalars” like Nvidia, highlighting their potential risks. Instead, Dalio advised investors to prioritize productivity, innovation, and disruptive technologies, while carefully considering pricing and global economic trends. He emphasized investing in those developing and utilizing applications that drive positive change.

Despite the changes to ‘Magnificent 7’ stocks, exchange-traded funds took the highest position in the value terms in Bridgewater’s portfolio. The fund held $4.824 billion and $1.2 billion in ETFs tracking the S&P 500 index and $922.163 million in the ETF tracking the MSCI Emerging Markets index.

| ETFs | Holdings (as of Sept. 30) | Holdings (as of Dec. 31) | Change (in %) | Value As Of Dec. 31 |

| SPDR S&P 500 ETF Trust (NYSE:SPY) | 836,965 | 8,232,049 | 884% | $4.824 billion |

| iShares Core S&P 500 ETF (NYSE:IVV) | 2,222,834 | 2,039,343 | -8% | $1.2 billion |

| iShares Core MSCI Emerging Markets ETF (NYSE:IEMG) | 17,779,378 | 17,659,209 | -1% | $922.163 million |

Read Next:

Photo courtesy: Shutterstock