Waters Corporation (NYSE:WAT) will release earnings results for the second quarter before the opening bell on Monday, Aug. 4.

Analysts expect the Milford, Massachusetts-based company to report quarterly earnings at $2.94 per share, up from $2.63 per share in the year-ago period. Waters is projected to report quarterly revenue of $748.51 million, compared to $708.53 million a year earlier, according to data from Benzinga Pro.

On July 14, Waters agreed to combine Becton, Dickinson’s Biosciences & Diagnostic Solutions business with Waters.

Waters shares rose 0.5% to close at $290.31 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

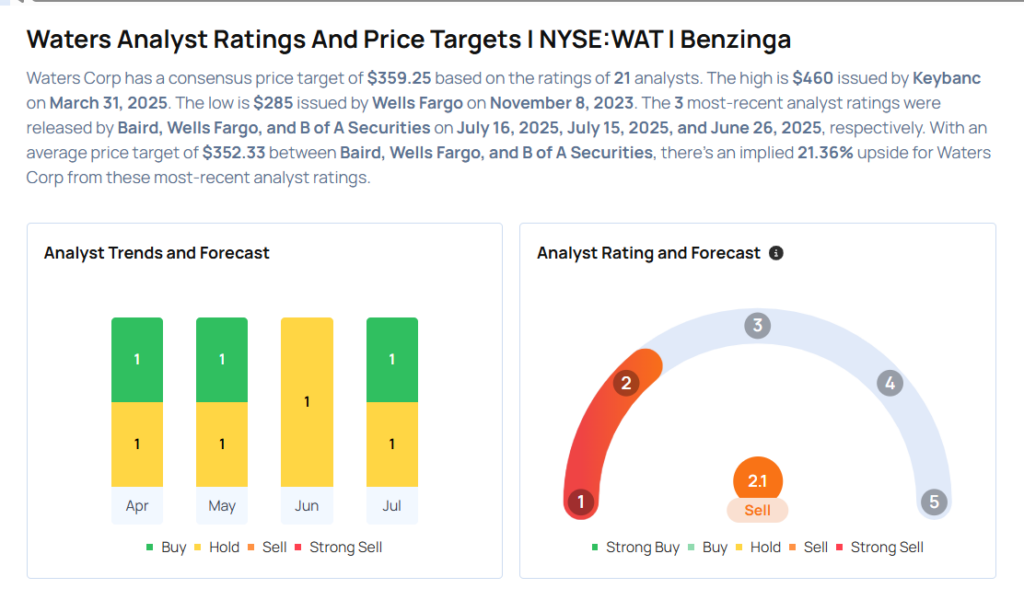

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Brandon Couillard downgraded the stock from Overweight to Equal-Weight and cut the price target from $420 to $330 on July 15, 2025. This analyst has an accuracy rate of 70%.

- B of A Securities analyst Derik De Bruin maintained a Neutral rating and raised the price target from $370 to $375 on June 26, 2025. This analyst has an accuracy rate of 75%.

- UBS analyst Elizabeth Garcia maintained a Neutral rating and cut the price target from $415 to $360 on May 7, 2025. This analyst has an accuracy rate of 68%.

- JP Morgan analyst Rachel Vatnsdal maintained a Neutral rating and raised the price target from $380 to $390 on March 6, 2025. This analyst has an accuracy rate of 63%.

- TD Cowen analyst Dan Brennan maintained a Hold rating and increased the price target from $363 to $410 on Nov. 4, 2024. This analyst has an accuracy rate of 64%

Considering buying WAT stock? Here’s what analysts think:

Wall Street’s Most Accurate Analysts Weigh In On 3 Health Care Stocks With Over 3% Dividend Yields

Photo via Shutterstock