General Motors Co. (NYSE:GM) has reportedly backtracked on its plans to offer incentives on electric vehicles in the U.S. beyond the Federal EV Credit deadline on September 30. Ford Motor Co. (NYSE:F) was also offering a similar incentive.

Bernie Moreno Raised Concerns

GM pulled the plug on EV incentives after Sen. Bernie Moreno (R-OH) expressed concerns about the automaker using its financing arm to make a down payment on the dealers’ inventory on or before September 30 to qualify the vehicle for the tax credit, Reuters reported on Wednesday.

General Motors did not immediately respond to Benzinga‘s request for comment.

“After further consideration, we have decided not to claim the tax credit,” the company said in a statement, adding that it would fund lease terms through October. Moreno said he was happy with GM’s decision. “We’re putting a lot of policies in place to protect our domestic auto industry,” he said in the report.

Moreno, a former car dealer, had earlier said that companies carrying out final assembly in the U.S. could face tariff relief as the Trump administration could extend existing tariff offsets to reward automakers.

GM Financial, the company’s finance arm, would pay over 5% of the vehicle’s total value as a down payment to dealers to qualify it for the Federal EV credit, with the automaker targeting 20,000 units for the scheme, the report suggests.

Automakers React To EV Credit Deadline, Ford’s Low-Interest Loans

Major Automakers in the U.S. have reportedly offered extensions on the EV incentives. Besides Ford, cross-town rival Stellantis NV (NYSE:STLA) is also offering incentives to EV buyers in the U.S. Meanwhile, Hyundai Motor Co. (NYSE:HYMLF) slashed the price of its Ioniq 5 EV and is offering incentives on the vehicle.

Elsewhere, Ford was reportedly offering low-interest loans to customers with a subprime credit rating (FICO scores below 620) on its best-selling F-150 pickup truck.

Former Tesla Sales Chief Thinks EV Sales Will Grow Without Incentives

Interestingly, Jon McNeill, who was Tesla Inc.‘s (NASDAQ:TSLA) former President for Global Sales and Service and currently serves as a member of the GM board, recently said that EV sales in the U.S. would grow despite the rolling back of incentives by Trump.

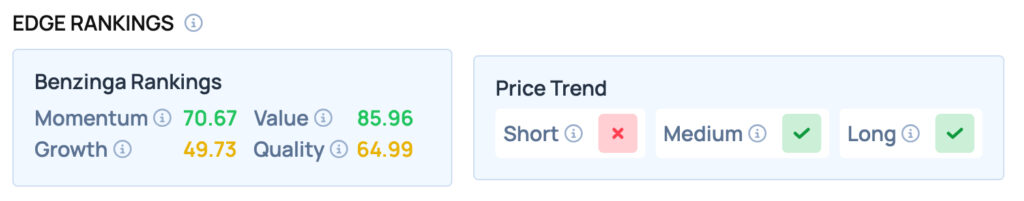

GM offers good Momentum and Value and scores satisfactorily on the Quality and Growth metrics. GM also offers a favorable price trend in the Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Jonathan Weiss / Shutterstock.com