Social media platform Reddit Inc. (NYSE: RDDT) had a strong second-quarter performance, with its profitability metrics now within striking distance of mature social networking companies such as Meta Platforms Inc. (NASDAQ:META).

Check out the current price of RDDT stock here.

What Happened: During its second-quarter earnings call on Thursday, the company reported an adjusted EBITDA of $167 million, from total revenue of $500 million, resulting in EBITDA margins of 33%. This was largely driven by rapid top-line growth, alongside tight expense controls during the quarter.

The company’s CFO, Drew Vollero, said, “We found a sweet spot this quarter with both revenue growth and profitability,” referring to a 78% surge in revenues.

See Also: Behind the Scenes of Reddit’s Latest Options Trends

What makes Reddit’s margin profile stand out is that the company is still in the early stages of its monetization efforts. As Vollero pointed out, the company’s average revenue per user (ARPU) soared 47% year-over-year to $4.53, while noting that it was “still low on an absolute basis and remains an opportunity.”

In comparison, Reddit’s top competitor in the social media space, Meta Platforms Inc. (NASDAQ:META), with its massive scale and infrastructure, reported EBITDA margins of 43%.

Reddit notes that several key monetization levers, such as its self-serve ad automation, performance measurement tools, and advertiser onboarding, are still being built. “We are not yet end-to-end automated,” said COO Jen Wong, referring to plenty of untapped potential from mid-market and SMB advertisers, when it does get fully automated.

| Stock | Year-To-Date Performance |

| Reddit Inc. (NYSE: RDDT) | -3.21% |

| Meta Platforms Inc. (NASDAQ:META) | +29.07% |

Why It Matters: Reddit released its second-quarter results on Thursday, reporting $499.6 million in revenue, up 78% year-over-year, and beating consensus estimates at $424 million.

The company reported a profit of 48 cents per share, once again beating analyst consensus estimates by a wide margin of 19 cents per share.

Price Action: Shares of Reddit were up 7.54% on Thursday, closing at $160.59, and are up another 17.82% after hours, following its earnings announcement.

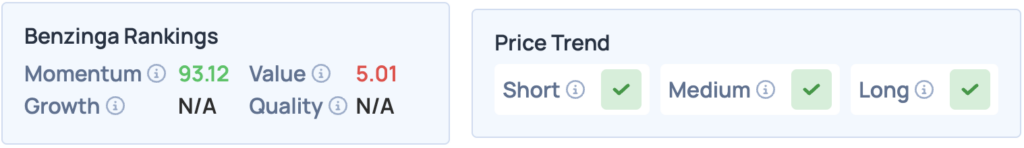

According to Benzinga’s Edge Stock Rankings, Reddit shares score high on Momentum, and have a favorable price trend in the short, medium and long terms. How does it compare with Meta Platforms? Click here to find out.

Read More:

Photo courtesy: Ink Drop On Shutterstock