The most oversold stocks in the utilities sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Brookfield Infrastructure Partners L.P. (NYSE:BIP)

- On July 31, Brookfield Infrastructure posted a loss for the second quarter. “We had an active second quarter with our capital recycling strategy. We made three marquee acquisitions and also generated substantial proceeds from asset sales,” said Sam Pollock, Chief Executive Officer of Brookfield Infrastructure. “Our ability to consistently buy high-quality assets for value and monetize mature investments at attractive returns, continues to differentiate our platform and positions us well to self-fund a growing pipeline of opportunities.” The company’s stock fell around 8% over the past month and has a 52-week low of $25.72.

- RSI Value: 27

- BIP Price Action: Shares of Brookfield Infrastructure Partners fell 0.2% to close at $29.81 on Friday.

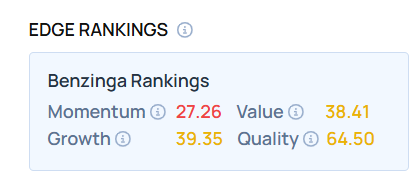

- Edge Stock Ratings: 27.26 Momentum score with Value at 38.41.

Genie Energy Ltd (NYSE:GNE)

- On Aug. 7, Genie Energy posted a decline in quarterly EPS. Michael Stein, Chief Executive Officer of Genie Energy, said, “Our second quarter yielded mixed results with solid operational progress and double-digit topline growth, while significant margin compression at GRE weighed on our bottom-line.” The company’s stock fell around 24% over the past month and has a 52-week low of $13.05.

- RSI Value: 20.8

- GNE Price Action: Shares of Genie Energy fell 2.3% to close at $15.46 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in GNE stock.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Energy Stocks With Over 8% Dividend Yields

Photo via Shutterstock