Wearable Devices Ltd. (NASDAQ:WLDS) shares surged during Wednesday’s regular trading, with after-hours trading at $6.12, up 18.15%.

Check out the current price of WLDS stock here.

Patent Technology Drives Market Confidence

The Israeli company secured a U.S. patent on Wednesday for its “Gesture and Voice Controlled Interface Device” technology. The patented innovation integrates voice commands, gesture recognition, and biometric authentication to improve user interaction.

Revenue Growth Signals Commercial Success

Wearable Devices reported $294,000 in first-half 2025 sales, marking its commercial debut with the AI-powered Mudra Link wristband. Revenue included early sales of the gesture control device and ongoing sales of the Mudra Band for Apple Inc. (NASDAQ:AAPL) Watch.

See Also: Oracle Surges In After-Hours Trading After Popping 36%, Larry Ellison Briefly Becomes Richest Person

CEO Asher Dahan pointed to solid revenue growth across both products and noted the company’s move into the global wearable technology market.

Strategic Expansion Fuels Growth

The gesture tech also announced military projects focused on touchless neural control systems and plans to expand in Japan through a partnership with Media Exceed Co., a Japanese distributor of tech products. These efforts support the growth of their patent portfolio in neural interface technology.

Financial Performance Improves

Wearable Devices cut its net loss to $3.7 million, or $2.30 per share, down from $4.2 million, or $16.52 per share, in the same period last year. The smaller loss was mainly driven by reduced spending in research, sales, and administrative operations.

The price of WLDS has ranged from $1.00 to $27.00 over the past year, with a market capitalization of $5.33 million.

Price Action: According to Benzinga Pro data, WLDS shares skyrocketed on Wednesday, surging nearly 978% from a prior close of $1.01 to reach an intraday high of $10.89. The stock also swung sharply within the session, climbing 147% from its low of $4.41 to the peak, before settling at $5.18 at the close of regular trading.

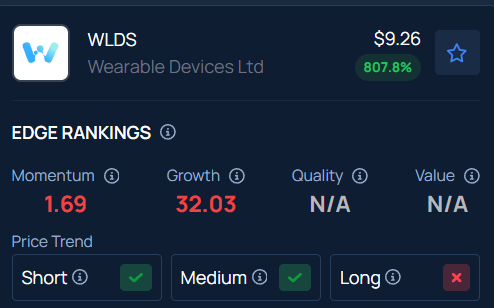

Benzinga’s Edge Stock Rankings indicate that WLDS is experiencing long-term consolidation along with medium and short-term upward movement. Here is how the stock fares on other parameters.

Read Next:

Photo Courtesy: IncrediVFX on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.