Shopify Inc. (NASDAQ:SHOP) will release earnings results for the first quarter, before the opening bell on Thursday, May 8.

Analysts expect the Ottawa, Canada-based company to report quarterly earnings at 26 cents per share, up from 20 cents per share in the year-ago period. Shopify projects to report quarterly revenue at $2.33 billion, compared to $1.86 billion a year earlier, according to data from Benzinga Pro.

Affirm Holdings, Inc. (NASDAQ:AFRM) and Shopify announced on April 9 that they are accelerating their global expansion plans.

Shopify shares rose 0.7% to close at $94.50 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

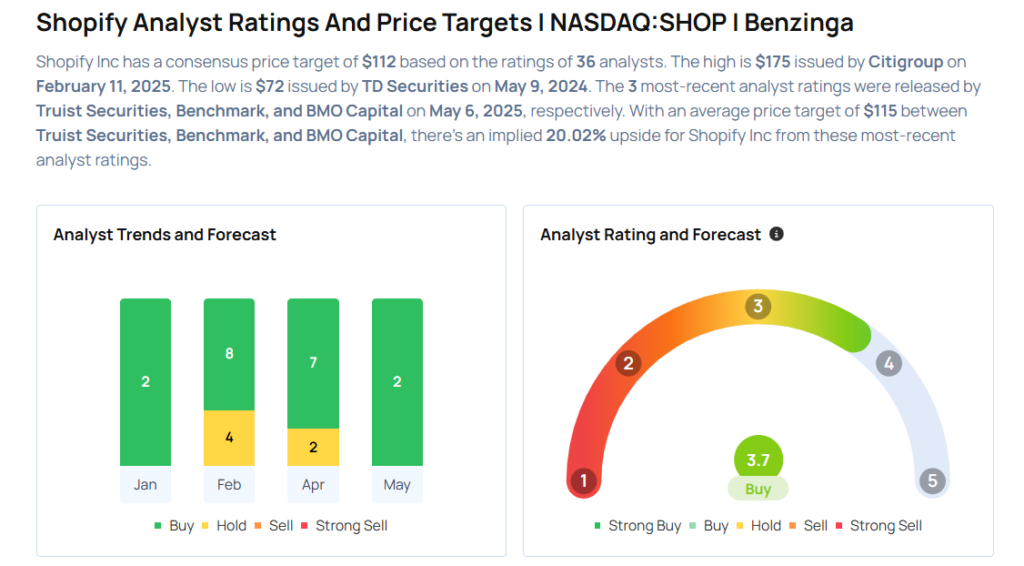

- Truist Securities analyst Terry Tillman maintained a Hold rating and cut the price target from $120 to $100 on May 6, 2025. This analyst has an accuracy rate of 61%.

- Benchmark analyst Mark Zgutowicz maintained a Buy rating and cut the price target from $150 to $125 on May 6, 2025. This analyst has an accuracy rate of 62%.

- BMO Capital analyst Thomas Moschopoulos initiated coverage on the stock with an Outperform rating and a price target of $120 on May 6, 2025. This analyst has an accuracy rate of 75%.

- Oppenheimer analyst Ken Wong maintained an Outperform rating and slashed the price target from $150 to $125 on April 30, 2025. This analyst has an accuracy rate of 73%.

- Keybanc analyst Philip Gibbs maintained an Overweight rating and cut the price target from $140 to $105 on April 23, 2025. This analyst has an accuracy rate of 84%.

Considering buying SHOP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock