Uber Technologies, Inc. (NYSE:UBER) will release its fourth-quarter financial results before the opening bell on Wednesday, Feb. 5.

Analysts expect the San Francisco, California-based company to report quarterly earnings at 50 cents per share, down from 66 cents per share in the year-ago period. Uber projects quarterly revenue of $11.77 billion, compared to $9.94 billion a year earlier, according to data from Benzinga Pro.

Uber’s gross bookings grew by 16% to $40.97 billion in the third quarter, though this growth rate was slower than the previous year. The company reported 161 million users in the third quarter, up 13.4% year-over-year.

Uber shares gained 3.7% to close at $69.75 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

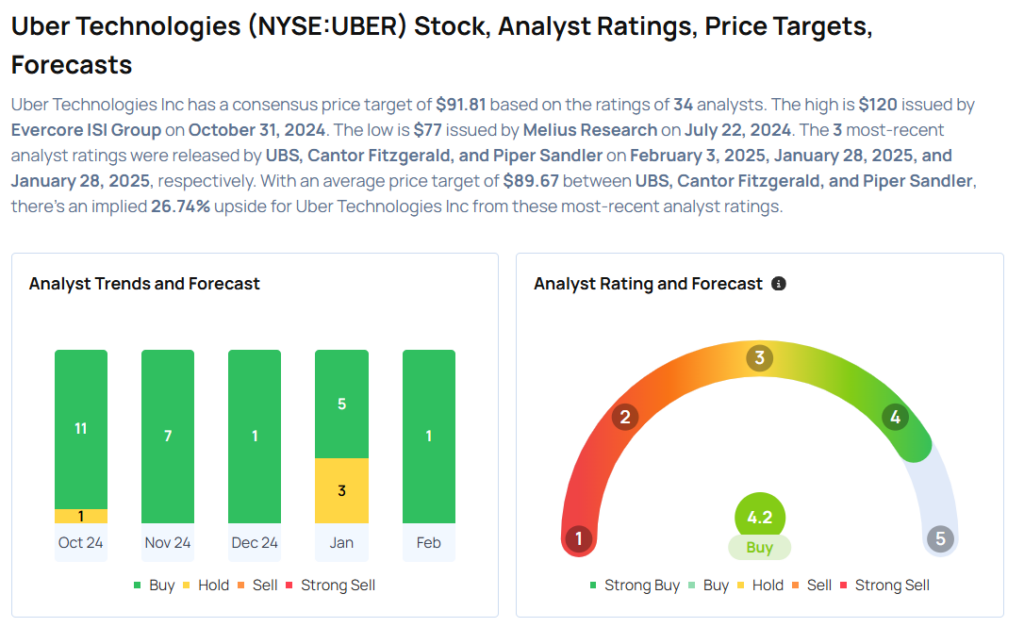

- UBS analyst Lloyd Walmsley maintained a Buy rating and cut the price target from $114 to $107 on Feb. 3, 2025. This analyst has an accuracy rate of 85%.

- JMP Securities analyst Andrew Boone reiterated a Market Perform rating on Jan. 31, 2025. This analyst has an accuracy rate of 82%.

- Benchmark analyst Daniel Kurnos reiterated a Hold rating on Jan. 31, 2025. This analyst has an accuracy rate of 76%.

- Cantor Fitzgerald analyst Deepak Mathivanan maintained an Overweight rating and boosted the price target from $75 to $80 on Jan. 28, 2025. This analyst has an accuracy rate of 80%.

- Piper Sandler analyst Thomas Champion maintained an Overweight rating and cut the price target from $98 to $82 on Jan. 28, 2025. This analyst has an accuracy rate of 69%.

Considering buying UBER stock? Here’s what analysts think:

Read This Next: