In response to President-elect Donald Trump’s threats to isolate Chinese goods from the U.S. market, China is reportedly seeking to engage U.S. allies in Europe and Asia to mitigate the potential impact on its economy.

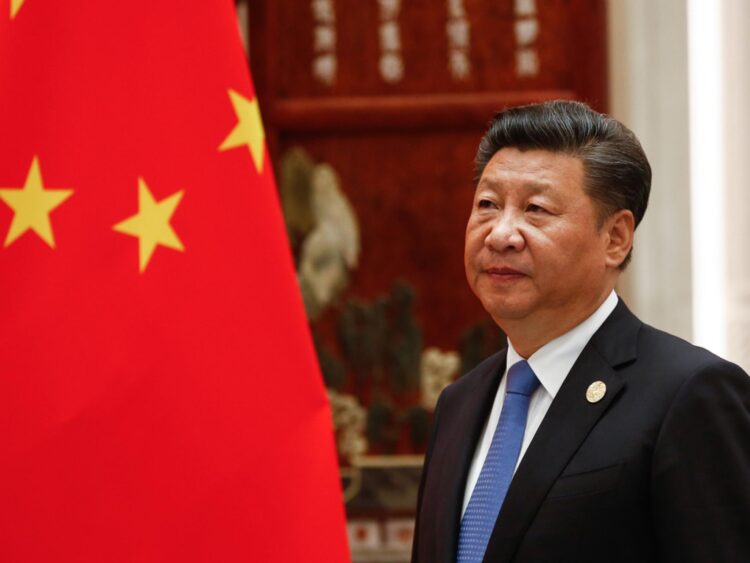

What Happened: Trump’s campaign promise to impose tariffs of up to 60% on Chinese imports poses a significant threat to Xi Jinping‘s economic model, which is heavily reliant on manufacturing and exports, reported The Wall Street Journal on Thursday.

To counter this, the Chinese leadership is reportedly considering offering tariff cuts, visa exemptions, and other incentives to U.S. allies in Europe and Asia. This strategy, termed “unilateral opening,” represents a shift from China’s traditional quid-pro-quo approach to economic and diplomatic deals.

See Also: Kentucky Gov. Beshear: ‘The Jury Is No Longer Out,’ Kentuckians Want Medical Cannabis

Despite this, China faces resistance from U.S. allies, with the European Union (EU) expressing discontent over China’s support for Russia’s actions in Ukraine. Meanwhile, U.S. allies in Asia, such as Japan, South Korea, and the Philippines, are growing increasingly wary of China’s assertive behavior.

China has already lifted visa restrictions for travelers from over 20 nations, including Australia, New Zealand, Denmark, Finland, and South Korea. Additionally, the country is contemplating significant tariff reductions in various industries, including electrical and telecommunications equipment, seafood, and agricultural products. These moves are seen as part of China’s broader strategy to stimulate economic growth and strengthen its trade relations.

Chinese Premier Li Qiang stated at a trade fair in Shanghai that China would continue to pursue unilateral opening to provide opportunities for foreigners to access the Chinese market.

Why It Matters: Through this new strategy, Beijing aims to capitalize on fears in Europe and Asia that Trump will revive his often hostile rhetoric against U.S. allies. By taking the initiative, China hopes to increase pressure on the U.S. and attempt to divide its allies.

Trump’s victory in the U.S. presidential election has also led to a decline in U.S.-listed Chinese stocks, with analysts warning of a potential escalation in U.S.-China tensions and its impact on trade policies. Major U.S.-listed Chinese stocks Alibaba Group Holding (NYSE:BABA), JD.com, Inc. (NASDAQ: JD), Baidu, Inc. (NASDAQ:BIDU), NIO Inc. (NYSE: NIO), Li Auto Inc. (NASDAQ:LI), and XPeng Inc. (NYSE: XPEV) were trading lower in the U.S. after Trump’s victory.

Read Next: How To Earn $500 A Month From Nvidia Stock After Trump Win

Photo by Gil Corzo on Shutterstock